Spain’s housing market enters a new expansionary phase

- 3 oct 2025

- 4 Min. de lectura

The Spanish housing market is in the midst of a boom, driven by lower interest rates, the improvement in purchasing power and population growth. Demand continues to grow sharply, with foreign buyers playing a notable role, while supply is also steadily gaining traction, although it still does not compensate for the housing deficit accumulated since 2021. House prices continue to accelerate, now exceeding the peak reached in 2007 in nominal terms, and signs of overvaluation are beginning to become apparent. However, the current context differs from the one prior to the bursting of the housing bubble: rather than an oversupply, there is a serious housing deficit, and that is what primarily explains the pressure on prices; moreover, households, the construction and developer sector, and the financial system are in a strong financial position. We expect prices and sales to remain dynamic in the coming quarters, underscoring the need to increase the supply of affordable housing.

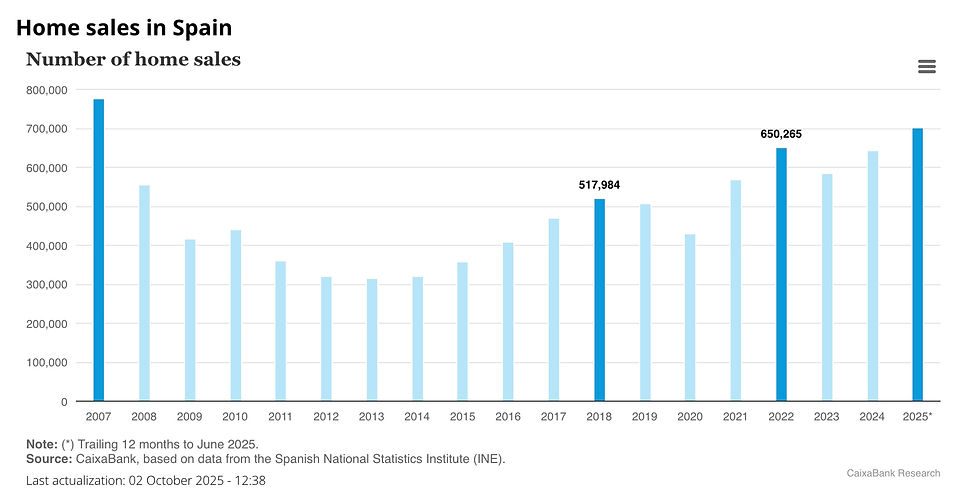

Housing demand has undergone a rapid revival since mid-2024 and is at levels not seen since 2007

Thus, in the trailing 12 months to June 2025, there have been some 700,000 sales (according to data from the National Statistics Institute, or INE), 19.7% more than in the first half of the previous year, reaching levels not seen since 2007.1 However, while the volume of transactions is very high, the demographic pressure is now greater than it was then: there are 4.3 million more people and 3.2 million more households than in 2007. In the 12 months to June 2025, some 14.3 transactions per 1,000 inhabitants have been closed, well below the 17.3 reached in 2007. Also, most transactions correspond to existing homes, although the sale of new homes is gaining traction thanks to the gradual recovery of supply (22.2% in S1 2025 versus 21.0% in 2024). However, the current figures fall far short of 2007 levels, when 42.1% of sales involved new homes, reflecting the construction boom of that period, as we will analyse later.

In recent quarters, the revival of demand is widespread, occurring across the various types of buyers. Although the latest boom is primarily driven by purchases made by Spanish citizens, the role of foreign buyers is far from negligible: foreigners acquired around 50,000 homes in S1 2025, according to the Association of Property Registrars, which represents 14.1% of all sales (compared to a historical average of 10.5% in the period 2006-2024) and is 15% more than in the same period last year.2 In the article «How has the profile of non-resident foreigners who buy homes in Spain changed?» of this report, we delve into how foreign demand has influenced the behaviour of the housing market in this period.

The supply of new housing has undergone a rapid revival in 2025, but is still far from compensating for the deficit accumulated since 2021

In the trailing 12 months to May, around 132,000 new homes were approved, representing a 13% increase year-on-year, on top of the 17% increase registered in 2024. Moreover, this trend is expected to continue to steady increase, taking into account the continuing strength of demand and the intention of the property developer sector to continue to grow the current housing stock. However, this increase in supply remains insufficient to absorb demand and close the accumulated deficit of more than 500,000 homes since 2021. In this same report we analyse in detail this accumulated deficit by region, in the article «The price of not building: how the housing deficit explains much of the price pressures».

The labour market continues to create employment in the sector and there has been a dramatic reduction in temporary employment in construction

The rest of the sector’s supply indicators offer a similar reading and show a gradual but modest improvement. On the one hand, the apparent consumption of cement is close to the levels seen in 2012 (around 15 million tons in the trailing 12 months to January) and is growing at a rate of 4% per year. On the other hand, the labour market is showing a steady increase in the number of registered workers in the construction sector (3.5% year-on-year in August), outpacing the average for the economy as a whole (2.3%) and reaching approximately 1.45 million workers in total.

The construction sector has experienced a drastic reduction in temporary employment in recent years, consolidating its position as one of the branches of the economy that has made the most progress in this field since the 2021 labour reform came into force. In 2022, temporary contracts (full and part-time) accounted for around 35% of the total. In 2025, this figure has fallen to just 4.8%, which represents a structural transformation of the hiring model in the sector. Full-time permanent contracts have gone from representing 63% to 85.6% of the total, reflecting a clear commitment to job stability. There is also a slight increase in permanent part-time contracts (from 5.1% to 6.0%), suggesting greater flexibility within this stability. Finally, there has been an increase in the use of discontinuous fixed contracts – a format that is well-suited to a sector in which downtime between projects is frequent. Its growth suggests that companies are reorganising their workforce in order to maintain the employment relationship without resorting to dismissal, but in any case, this only explains a small part of the reduction in temporary employment in the construction sector.

Comentarios